MONEY SOLUTION CAFE

We Listen We Cater We Solve

BUSINESS SOLUTIONS

CREDIT REPAIR

TAX PREPARING

BOOKKEEPING

START LLC

Benefits of Filing Taxes with Money Solution Cafe

Maximize Your Refund

We guarantee the largest refund possibleaccurately and stress-free.

Business Tax Filing

Simplify personal and business taxes in one bundle.

Expert Support

Personalized advice and reviews from real experts.

Secure & Private

Your data is always safe with no sharing guarantee

Accuracy Guarantee

Count on us for precision guaranteed to achieve the goal.

Exceptional Care

Fast, reliable answers when you need them.

ABOUT US

The

Founder

Elyse Whisby, founder of Money Solution Cafe, is more than just a seasoned financial expert—she’s a mother of four sons, a devoted wife, and a proud Georgia native, born and raised in Macon. With over 25 years of experience in tax preparation, credit restoration, and small business consulting, Elyse has dedicated her life to helping others achieve financial freedom and security.

Money Solution

Cafe

Through Money Solution Cafe, Elyse continues to pour her heart into guiding individuals and small businesses toward success, proving that financial independence is achievable for anyone willing to work for it. Elyse’s story inspires others to dream big and reminds us all that with faith, focus, and effort, life’s greatest goals can be realized.

MONEY SOLUTION CAFE

Get a great deal

for your business taxes

Money Solution Café offers small business owners the tools they need to handle taxes with confidence. Our DIY tax filing solutions are designed to help you maximize every credit and deduction while ensuring 100% accurate calculations—guaranteed.

MONEY SOLUTION CAFE

Get a great deal

for your business taxes

Many businesses struggle to access funding due to poor credit profiles

With our Business Credit Services, we guide you step-by-step to build and maintain a stellar 80+ Paydex score, making your business funding-ready

PRICING

Single Filer

Starting at

$60

+ $0 per state filed

simple returns only

File online any time, on any device.

HEAD OF HOUS HOLD fILERS

WITH DEPENDENTS

Starting at

$375

+ $14 per state filed

simple returns only

File online any time, on any device.

SELF EMPLOYED FilERS

WITH DEPENDENTS

Starting at

$450

+ $14 per state filed

simple returns only

File online any time, on any device.

What Else

Articles

Credit Repair 101: Simple Steps to Rebuild Your Financial Health

Introduction:

Your credit score is more than just a number—it’s the key to unlocking financial opportunities, from securing loans and credit cards to renting a home or even landing a job. Unfortunately, life happens, and credit scores can take a hit due to missed payments, unexpected expenses, or financial mismanagement. The good news? Repairing your credit is not only possible but entirely within your control. In this blog, we’ll walk you through the basics of credit repair, actionable steps to improve your score, and how understanding your credit can set you on the path to financial success.

What Is Credit Repair?

Credit repair is the process of addressing and resolving negative items on your credit report that may be affecting your score. This can include disputing errors, paying off debts, negotiating settlements, or rebuilding your credit with positive habits. It's about taking proactive steps to present yourself as a reliable borrower to creditors.

Why Does Your Credit Score Matter?

Your credit score impacts several aspects of your financial life, including:

Loan Approvals: Higher scores mean better chances of approval and lower interest rates.

Credit Card Eligibility: A good score gives you access to premium cards with perks and benefits.

Employment Opportunities: Many employers check credit reports as part of their hiring process.

Insurance Premiums: In some cases, a better score can mean lower rates.

5 Steps to Start Repairing Your Credit Today

Check Your Credit Report Regularly

Start by obtaining a free copy of your credit report from all three major bureaus—Experian, Equifax, and TransUnion. Review it carefully for errors, such as incorrect balances or accounts you don’t recognize. These errors can hurt your score, so disputing them is crucial.Dispute Errors on Your Report

If you notice inaccuracies, file a dispute with the credit bureau that issued the report. Provide any supporting documentation to back your claim. Credit bureaus are required to investigate disputes within 30 days.Pay Down High Balances

Your credit utilization ratio (the percentage of your credit limit you’re using) plays a significant role in your score. Aim to keep this ratio below 30% to show lenders you’re managing your credit responsibly.Pay Bills on Time

Payment history accounts for 35% of your credit score. Setting up automatic payments or reminders can help you stay on track and avoid missed or late payments.Build Positive Credit Habits

Consider opening a secured credit card or becoming an authorized user on someone else’s card. Use credit wisely and pay off your balances in full each month to establish a track record of reliability.

The Role of Professional Credit Repair Services

While you can repair your credit on your own, working with a professional credit repair service can save you time and ensure every step is handled accurately. Experts can identify and dispute errors, negotiate with creditors, and guide you on the best practices for long-term success.

At Money Solution Cafe, we specialize in helping individuals rebuild their credit and regain financial freedom. Our proven strategies and personalized approach ensure you’re on the fastest track to improving your credit score.

Myths About Credit Repair

There’s a lot of misinformation about credit repair. Let’s debunk a few common myths:

“You can pay someone to erase bad credit instantly.” No one can legally remove accurate negative information from your credit report.

“Closing old accounts will boost your score.” Closing accounts can hurt your score by reducing your credit history length.

“Checking your credit report will lower your score.” Soft inquiries, like checking your own credit, do not affect your score.

Start Building a Brighter Financial Future Today

Repairing your credit is not an overnight process, but with consistency, patience, and the right tools, you can achieve significant improvements. Every small step you take today gets you closer to financial freedom tomorrow.

A solution for every tax payer

Get your max refund with

100% Accuracy Guarantee

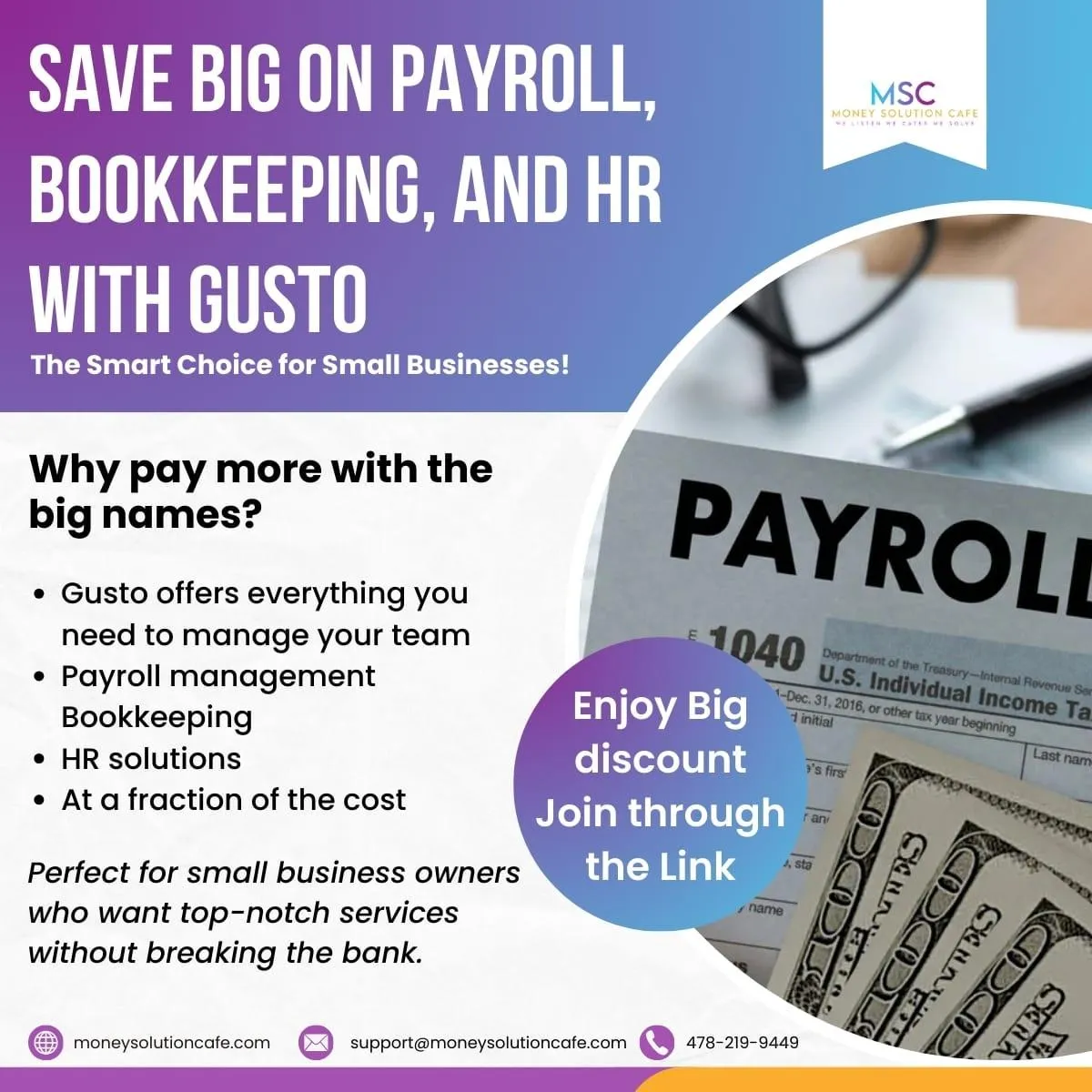

Affordable Payroll, Bookkeeping, and HR Solutions With

“GUSTO”

Refer a friend and make some extra cash

Connect With Us

I agree to terms & conditions provided by the company. By providing my phone number, I agree to receive text messages from Money Solution Cafe.

Privacy Policy & Terms of Service

By providing your phone number, you consent to receive SMS messages from Money Solution Cafe. Standard message and data rates may apply. You can opt-out at any time by replying "STOP" to any message.

We may collect your phone number and usage data for communication and service improvement purposes. Your data may be shared with third-party service providers like Twilio to deliver SMS messages. We take reasonable steps to protect your information but cannot guarantee absolute security.

For more details on how we collect and use your information.

By consenting, you agree to receive marketing messages, reminders, or other notifications related to our services. You can withdraw consent anytime by replying "STOP" to any SMS message.

COMPANY

CUSTOMER CARE

+1 478-999-7456

LEGAL

© Copyright 2025 - moneysolutioncafe.com- All Rights Reserved